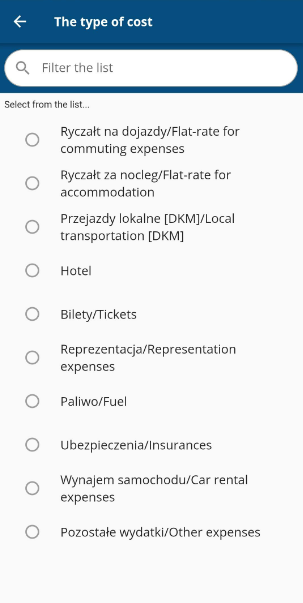

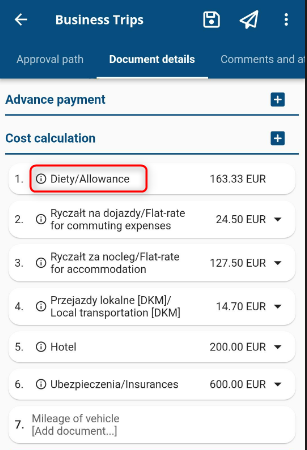

Click the “+” button next to the name of the COST CALCULATION section to record the costs that were incurred during the business trip.

Depending on the parameterization of the system, several different types of cost may be available. To add them to the calculation, select the proper item in the list, fill in the data for the selected cost and confirm.

Below is a description of the most commonly used cost groups.

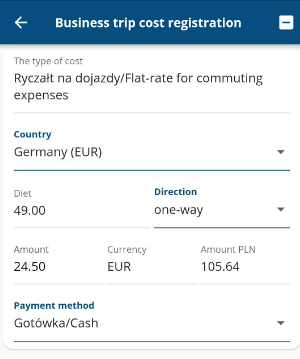

1) Flat-rate for commuting expenses

Select Country, direction of commuting and payment method.

2) Flat-rate for accomodation

Choose the country, enter the number of days and select the payment method.

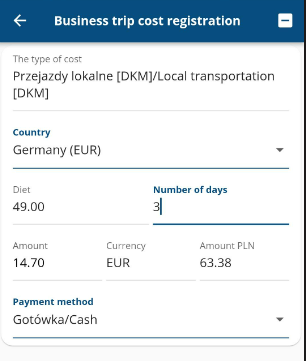

3 Local transportation

To enter the cost related to transportation rides in the locality where the business trip is taking place, enter the country, indicate the number of days and the payment method.

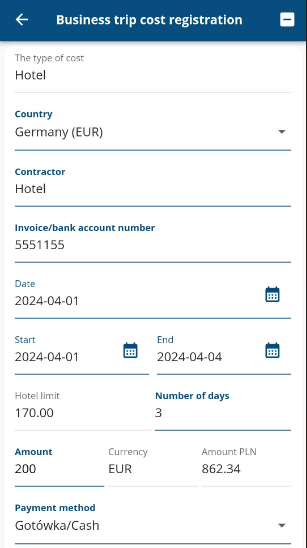

4 Hotel

Select the country to which the cost applies from the list, enter the number of days, amount and select the payment method. The amount must not exceed the hotel limit, entering a higher amount will result in a warning message

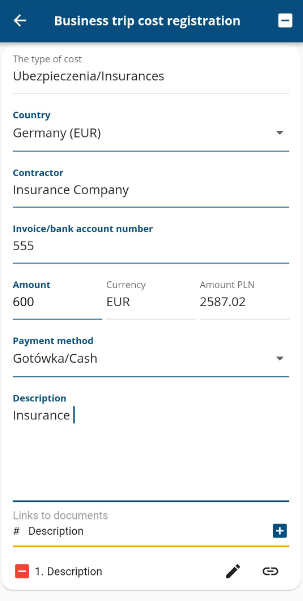

Note: The types of costs and the required data are determined by the accounting department. Another example cost could be cost – INSURANCE, and the required data could be:

– country

– name of the contractor

– invoice/account number

– amount

– method of payment

– description

– link to the document related to the expense

Allowances

The cost related to Allowances in the trip settlement will appear automatically. To define the cost, click on the link.

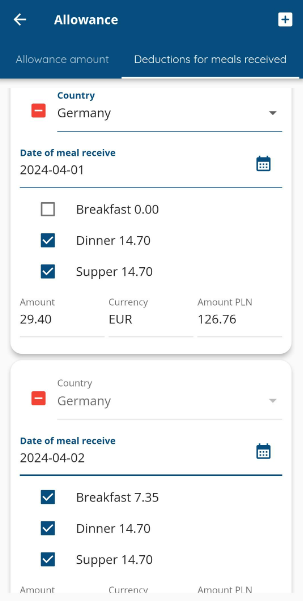

A window with two tabs will be displayed: ALLOWANCE AMOUNT and DEDUCTIONS FOR MEALS RECEIVED. In the second tab, enter the meals provided during the business trip. Click the + button to add a new line. Enter the date you received the meal, select the country you were in on the specified date from the list, select which meals you received and confirm.

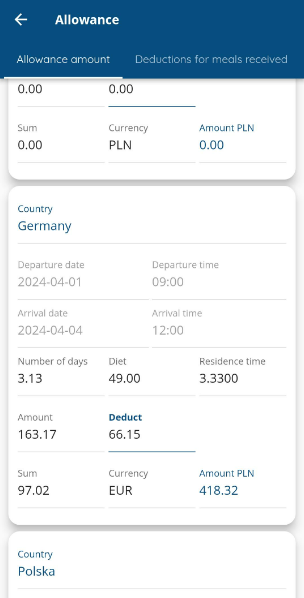

Deductions for the meals provided will be recalculated and summarized in the first tab of the Allowances.

The settlements update in the table: